Let us see what are the main advantage as well as disadvantages of this payment method. Cashless payment options also rely on electricity – so any power outages will stop your payment system from working. This can lead to the business having to close its doors temporarily and losing customers.

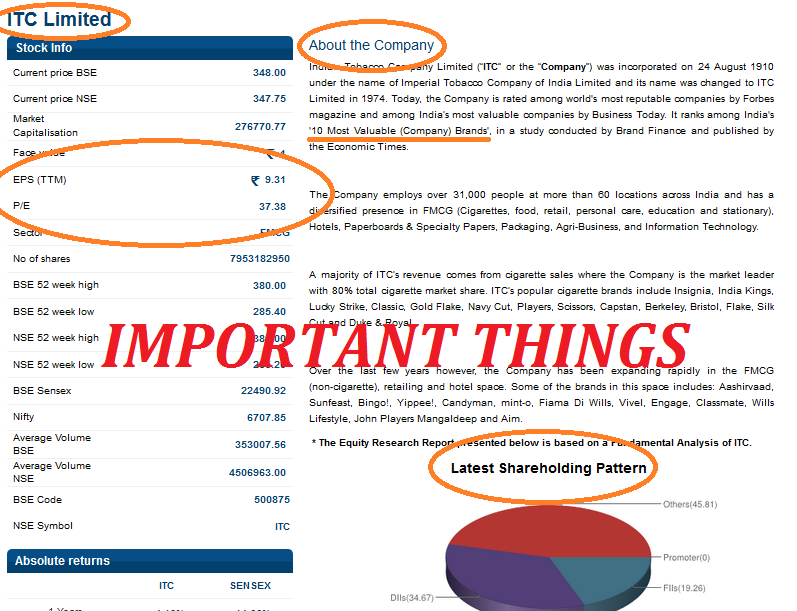

The transfer of funds from one party to another over electronic media is known as electronic payment. The different approaches to electronic payments include card payment, mail order, and online payment. With the introduction of the Internet, online transactions became easy. Most product and service companies made their web presence prominent and started interacting with their customers online. With financial institutions working on similar lines, people around the world began to carry out financial transactions over the Internet. Credit and debit cards became commonplace and gave impetus to electronic payment systems.

What Are Online Payments?

Online payments have their own set of drawbacks that you need to be aware of, despite the fact that they are often thought to be advantageous for many obvious reasons. After all, in the modern digital environment, every useful function carries a little amount of danger. Most of these drawbacks are manageable with proper precautions and management.

Merchant accounts and payment gateways function as the traditional one-two punch for business credit payments. First, money arrives in the merchant account, a holding zone where money sits before being disbursed to individual bank accounts. Join us as we explore the different types of electronic payments and offer Stampli Card, our virtual payment solution. Additionally, the concept of making a profit is only possible if your company allows clients to make online payments. Online payments have grown in importance because of the recent technological innovations in the e-commerce sector. Given the many advantages that come with online payment tools, it makes sense why they wouldn’t.

What Are The Most Common Types of Electronic Payments?

For your business to be able to accept e-payments in person, you’ll need to sign up with a payment processor provider so that you have the physical means to process those purchases. Some firms may charge setup fees or even processing fees for consumers utilising such facilities when deploying online payment gateways. Both the merchants and the buyers may find this annoying as it easily results in additional expenses. You may quickly and simply integrate online payment gateways for your company instead of taking the time to build up a comprehensive payment procedure that requires specific hardware and additional staff. However, you may compare the many possibilities before selecting the services of a certain vendor in order to choose the best one.

- The mobile banking apps in turn receive a commission from the banks every time people make transactions with the help of it.

- Digital payments are still a relatively new solution in B2B purchasing.

- Next, we’ll examine an emerging method that’s more secure than credit cards.

- Processing supplier payments the traditional way takes a lot of time.

- Even compared to conventional magnetic or chip cards, new technology avoids direct contact with your money.

- With online payment methods, all you have to do is remember a certain pin to complete your purchase!

In conclusion, even if electronic payment systems provide numerous advantages, there are still several possible drawbacks to consider. These include the possibility of cyberattacks and other fraud schemes, dependability problems, a lack of availability, regional unacceptance, and complexity. When determining whether to utilize electronic payment systems, one should consider these concerns versus the advantages. In this, customers must first pay before they can purchase a good or service. Smart cards are sometimes known as virtual wallets or electronic purses.

Concept of E Commerce

Although stringent measures such as symmetric encryption are in place to make e-payment safe and secure, it is still vulnerable to hacking. Fraudsters, for instance, use phishing attacks to trick unsuspecting users into providing the log-in details of their e-wallets, which they capture and use to access the victims’ personal and financial information. Without superior identity advantages and disadvantages of e payment system verification measures like biometrics and facial recognition, anyone can use another person’s cards and e-wallets and get away without being caught. These security concerns may make some people reluctant to use e-payment systems. The fact that many individuals, particularly the older population, lack basic computer literacy is one of the biggest drawbacks of online payments.

Businesses such as gas stations aren’t restricted to having to purchase clunky POS systems. The procedure for businesses to do this on a customer’s behalf is straightforward, with the business providing the bank with a reference number that is then factored into the transaction. Sometimes, the business will have a different bank than their customer. In these instances, the transaction is processed through a clearing house.

Advantages and disadvantages of contactless payments

Platforms like these take special measures to protect user information. They also offer detailed reporting, invoicing options, and a variety of payment options. These are some of the primary advantages of electronic payment system platforms, but there are plenty of other features that demonstrate the value that e-payment systems provide users. The convenience of online payment systems is unmatched by traditional payment methods and offers a quick, easy way to make transactions. While many electronic payment system providers will be happy to list the advantages of their systems, many of them will not mention three disadvantages of e payment system processes.

The Advantages and Disadvantages of Using a Hand Hygiene … – Infection Control Today

The Advantages and Disadvantages of Using a Hand Hygiene ….

Posted: Thu, 25 May 2023 07:00:00 GMT [source]

Systems may not come under direct attack, but phishing techniques can be used to obtain IDs and passwords. Once a hacker has these details, e-payments make it possible to process multiple payments before the genuine account holder notices. However, another factor you should consider is how much it will cost you to maintain your e-payment processor. Some providers charge a fixed amount for a card reader as well as a certain percentage of each transaction, whereas others offer a monthly rental price. It’s well worth taking the time to research which payment processor will work best for your business.

Beyond that, streamlining the payment process with electronic payments will reduce the number of late payments and therefore lower the number of supplier inquiries to your AP team. That’s a big time save considering 43% of AP teams spend over 6 hours a week answering vendor questions regarding payments. Improving and maintaining a strong supplier relationship is crucial, especially in the midst of an industry-wide supply chain disruption. Your money and other financial information are simpler to handle and store when you use online payments.

Any business that uses a PSP typically doesn’t have to worry about a merchant account or payment gateway, as the PSP will handle that on their end. They can also take care of payment card industry, or PCI compliance, as well as fraud monitoring, transfers, and payments. It’s worth noting that digital wallets are working on this problem and aiming for the opposite, trying to make it easy for people to pay by opening their phone and pressing a button.

There have been many incidents in which cybercriminals have manipulated people and money has been looted. As people are able to pay to anyone and are not much dependant, the demands of products in the market have increased which resulted to increase in sales of almost every product.

- All you need to do is spend a few minutes of your time and apply for a prepaid card.

- This is why companies that use e-payment systems should ensure the right safety measures, such as multifactor authentication, are put in place.

- Although these company cards can be useful, their rigidity and lack of visibility means they aren’t ideal for any e-payments you or your employees need to carry out.

- Typically, B2B ecommerce is more complex, requiring multiple stakeholders, extended sales cycles, higher-dollar sales, and more.

- Not only are paper-based payment methods expensive, but they are also slow.

In these instances, outsourcing to a third-party payment service provider (PSP) can be the best call. Often found online, these companies can act as go-betweens for companies and their vendors, helping ensure a smooth payment experience. They can leave businesses vulnerable to fraudsters with their banking information exposed. When data breaches occur, eChecks can also be passed off by unscrupulous third parties as coming from legitimate businesses. Virtual payment solutions, such Stampli Card, allow businesses to print cards with customizable numbers and set amounts that can be spent. An unlimited amount of custom numbers can be generated, and businesses have control over which specific users have access to each Stampli Card.

E-payment also eliminates the security risks that come with handling cash money. Unlike paper checks that take time to write, process, and eventually post to your supplier’s bank account, electronic payments are fast, transparent, and secure. Paying suppliers on time and offering them complete visibility into the payment process, will naturally improve your relationships with suppliers.