Content

The balance of this account will show either the amount owing to the other party or amount owned by the other party. To request a reduction in the amount owed to a seller, such as when returning faulty goods, the buyer issues a debit memo and debits Accounts Payable. Software like InvoiceOwl offers to prepare credit memos within a few clicks. Debit memos can also be used in invoicing, such as when debt that was previously written off is recovered. So how exactly do debit memos work and what do you need to know? The good news is we put together this guide to cover the most important pieces of information.

For instance, the supplier receives a purchase order from the buyer, but the last bills of the buyers are already overdue. This surcharge will amortize the cumulative balance recorded in the 2013 Interim Rate Memorandum Account, as of May 2017. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Likewise, these accounts allow monitoring administrative aspects, such as pending lawsuits or merchandise received on consignment.

Debit Memorandum (Memo) Definition

The memorandum, in this case, is called a debit memo because the sender of the memo debits the balance of accounts payable. The primary objective of this document is to provide clarity about the financial transaction. Sometimes, it can credit memo also serve as a reminder to adjust the accounts. However, it consists of a short message that becomes a part of the general journal and general ledger. A Special Memorandum Account is a specialized type of margin investment account.

The seller can then agree to the debit memorandum and adjust its accounts receivable for the discount as well. The seller should always review its open credit memos at the end of each reporting period to see if they can be linked to open accounts receivable. If this is allowed by the accounting software, it reduces the aggregate dollar amount of invoices outstanding, and can be used to reduce payments to suppliers.

What is the Rule 407 letter? – Definition, Explanation, Example, and More

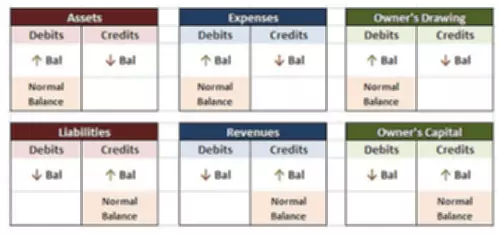

The difference between the two sides of the account will reveal the amount of profit or loss as per the financial accounts. Accounting for Cost of Services The cost of goods sold represents all direct costs incurred on manufacturing a product or acquiring it. Usually, it includes a company’s purchases and other similar expenses that directly contribute… Therefore, it can be seen that memorandums essentially serve the purpose of facilitating better results and record-keeping that mitigate the risk of errors when it comes to basic bookkeeping. GuideInvoicing Guide Know anything and everything about invoices and invoicing process. Receipt Maker Generate receipts within seconds through this invoicing software.

Any minor discrepancies between the two sets of accounts are ignored. The reconciliation of cost and financial accounts can also be presented in the form of an account prepared on a memorandum basis. Such an account is known as a memorandum reconciliation account. Further, it’s important to note that the memorandum might be internal or external as it may be issued by some department of the Company or external stakeholders like suppliers, customers, etc.

COMPANY

In accounting, it refers to an entry that serves as a notice to customers about their owed amount. Usually, it also includes a source document sent to the customer. Companies adjust the balance in the customer’s account through a debit memo. The term Special Memorandum Account refers to a special kind of margin account in which excess margin or equity is deposited. The amount in this SMA is then used to increase the buying power available to the account holder.

Most credit memos are issued under the circumstances of owed, accounts payable, and reduce payments. A debit memorandum is an accounting term referring to an entry that serves as a notice to customers about a change or adjustment to their account that decreases the balance. When this happens, the fees work as more of an adjustment instead of a specific transaction. Then, it gets debited from your account and is then recorded as a debit memo. In some cases, debit memos can get used to help rectify inaccurate account balances. The most common reasons involve a buyer returning goods, a price dispute, or as a marketing allowance.

What is Memorandum in Accounting? (Definition, Types, and Example)

Real-time Notification Get notified whenever estimates and invoices are opened or payouts proceeded. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, entrepreneur, and advisor for more than 25 years. Memorandum Accountmeans, collectively, all of the accounts that hold all of the deferred compensation credited to a Participant under Article III reduced to reflect distributions. One important thing to remember is that not all securities are eligible for margin trading and that there are some prohibitions related to SMAs.